#Portfolio Theory

It is impossible to generate the highest possible expected return without diversification or, put another way, impossible to have an efficient portfolio allocation when your assets are largely tied up in one illiquid, concentrated position.

Considering the well-established maths underlying portfolio theory, and the well-known fact that founders broadly have the overwhelming majority of their net worth tied up in their illiquid cap table wealth – their startup’s equity – it’s natural to seek a remedy in order to make founder portfolios more efficient.

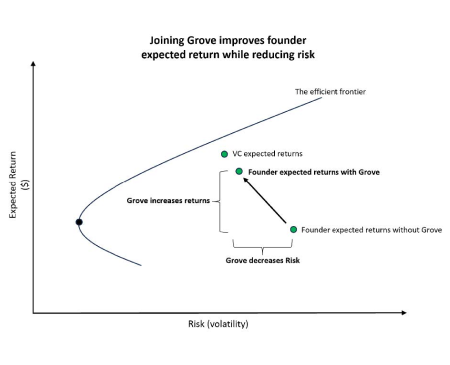

Grove’s network succeeds in this by bringing founders vastly closer to their efficient frontier. The efficient frontier is that portfolio allocation expected to generate the highest possible return for a given level of risk.

Through Grove, founders diversify a small percentage of their future exit liquidity, becoming exponentially diversified relative to their present state.

In finance parlance, Grove unambiguously moves founders closer to their efficient frontiers, which means the expected value of their net worth (i.e. their portfolio of assets & liabilities) increases at no additional risk.

This crucial understanding is how the Grove network makes 100% of founders better off at the time of joining.

Footnotes

- Markowitz (1952, 1959), Tobin (1958), Sharpe (1963, 1964), Lintner (1965), Mossin (1966), Merton (1972), and Ingersoll (1987) to name foundational works in portfolio theory, the CAPM, & the efficient frontier