#Value Capture

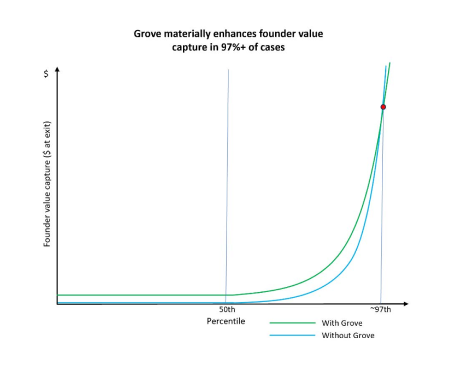

At right, we see a distribution of founder returns, by percentile rank, with and without the existence of Grove. The Y-axis represents the monetary value a founder captures from founding a startup, while the X-axis represents the percentile rank of founder outcomes. The world without Grove is represented by the blue line, and the world with Grove by the green line. Noticeably, the 50th percentile founder without Grove captures absolutely zero value from their startup. Somewhere above the 50th percentile, around the 60th, founders slowly start capturing progressively more and more value: their shares are worth more and more money.

With Grove, even unsuccessful founders will capture some of the value created by the founder ecosystem. This is because even founders who never successfully exit will be entitled to distributions from their participation in Grove for

- the period of time they’re building & growing their company

- the period of time between them failing, joining the exit queue, and eventually exiting once 30% of the network has failed after them.

Another way to think of this is as integrals. Grove takes the area below the blue line & above the green line for founders past the 97th percentile of success through to the 99th, and redistributes it to the area below the green line & above the blue line for founders who are at the 97th percentile of success or below. This means that by joining, 97% of founders will be better off ex post facto. It’s important to also understand that by joining, 100% of founders are better off ex ante. This is because of portfolio theory.

Footnotes

- It should be said that for simplicity, this section does not capture the 30% exit queue mechanism but shows a world where every founder stays in-network. Capturing it would make those in the lowest percentiles slightly worse off and benefit the founders at the highest percentiles.