#Bottom Up

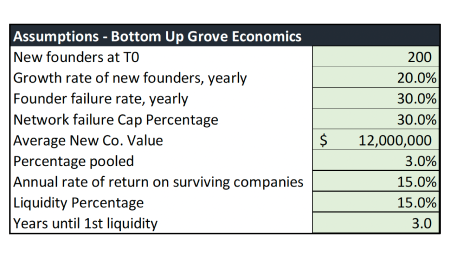

Given that one can view the “US venture” approach as a Grove network with no strict selection criteria other than being VC backed, and the “YC” approach as a Grove network having strict selection criteria, having the top-down model fall between this range is promising & confirms the two top-down scenarios as approximate lower and upper bounds of per participant network economics.

Conservatively valuing a dollar of cap table wealth 1:1 with an actual, liquid dollar, and using the NAV-in metric as a proxy for invested capital , Grove network participants can expect a return on invested capital (ROIC) averaging between 20% and 30% per year.

Footnotes

- The financial concept of liquidity preference outlines why a liquid dollar is worth more than an illiquid dollar or cap table wealth. By not discounting cap table wealth as the measure of invested capital, we are conservatively calculating ROIC